BGREEN TV: Your Source for Green Innovations

Explore the latest trends and innovations in sustainable living, eco-friendly technology, and green entertainment.

Marketplace Liquidity Models: Finding the Sweet Spot Between Buyers and Sellers

Discover the secret to marketplace success! Explore liquidity models that optimize the balance between buyers and sellers for ultimate profits.

Understanding Marketplace Liquidity: Key Models and Strategies

Understanding marketplace liquidity is essential for any investor or trader navigating financial markets. Liquidity refers to how easily assets can be bought or sold without causing significant price changes. There are several models that define and analyze liquidity, including the Order Book Model, which delineates how buy and sell orders are matched, and the Market Microstructure Theory, which explores the processes and mechanisms involved in the trading of securities. Recognizing these models helps participants make informed decisions, paving the way for effective trading strategies that leverage liquidity.

To successfully enhance marketplace liquidity, traders often adopt various strategies. One effective approach is Market Making, which involves providing both buy and sell orders at specified prices, thereby facilitating transactions and reducing spreads. Another strategy is Cross-Market Arbitrage, where traders exploit price discrepancies across different marketplaces to maximize profitability. Amid evolving market conditions, understanding these strategies is vital for maintaining advantageous positions and ensuring liquidity in an increasingly dynamic environment.

Counter-Strike is a popular first-person shooter game that has captivated millions of players around the world. It involves team-based gameplay where players can choose to be part of either the terrorist or counter-terrorist team. For those looking to enhance their gaming experience, using a daddyskins promo code can provide access to a variety of skins and upgrades. The competitive nature of the game, combined with its strategic elements, makes it a favorite among eSports enthusiasts.

How to Optimize Buyer and Seller Interaction in Your Marketplace

Optimizing buyer and seller interaction in your marketplace can lead to improved satisfaction and higher conversion rates. One effective strategy is to implement a robust communication system, allowing buyers and sellers to engage in real time. Consider using chat features and integrated messaging platforms that enable users to ask questions and clarify details before making a purchase. Additionally, providing a FAQ section can preemptively address common concerns, keeping the lines of communication open and fostering trust among users.

Another vital aspect of enhancing buyer and seller interaction is to cultivate a feedback mechanism. By encouraging users to leave reviews and ratings after transactions, you not only create a sense of accountability but also contribute to the overall quality of your marketplace. Incorporate a simple and user-friendly interface for submitting feedback, and consider implementing a reputation system. This helps build a community where buyers feel more confident in their purchases, and sellers are motivated to maintain high standards of service.

What Factors Influence Liquidity in Online Marketplaces?

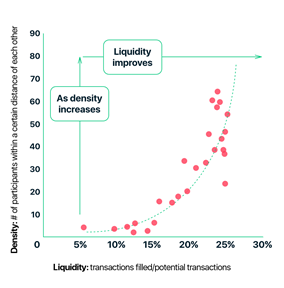

Liquidity in online marketplaces is influenced by several key factors that determine how quickly and efficiently transactions can occur. One significant factor is the number of participants in the marketplace. A larger pool of buyers and sellers typically leads to increased demand and supply, which facilitates quicker trades. Additionally, the variety of products available can impact liquidity; marketplaces offering a diverse range of goods are more likely to attract a wider audience, thereby enhancing liquidity. Marketplaces that implement effective search and filtering tools also contribute positively, as they enable users to find products faster, further increasing transaction speed.

Another crucial element is the transaction costs associated with buying and selling in the marketplace. Lower fees encourage more participants to engage actively, promoting liquidity. The trust factor plays an essential role as well; platforms that maintain a strong reputation and provide secure payment options foster greater confidence among users, encouraging them to trade more frequently. Finally, factors such as market trends and seasonal variations can also affect liquidity, as shifts in consumer demand influence how quickly items buy and sell. Understanding these dynamics is essential for stakeholders aiming to enhance their marketplace's liquidity.